As the economy expands and contracts, so do the financial performances of companies across the 11 stock sectors.

When the outlook is positive, economically sensitive companies perform better, prompting investors to buy their shares. If the outlook turns sour, investors may sell out of those companies and swap into ones that can better weather economic downturns. This practice is known as sector rotation.

Sector rotation is evidenced in its most basic form by the 10-year performances of value and growth companies. Growth stocks, which are more sensitive to interest rates and other economic factors, took advantage of favorable conditions across the decade and drastically outperformed value.

However, spiking treasury rates and inflation in Q1 2021 caused investors to rotate into value stocks, typically companies with steadier business models. Value outperformed growth in light of the economic backdrop as rotations were made in droves, given the higher volume of shares that traded hands.

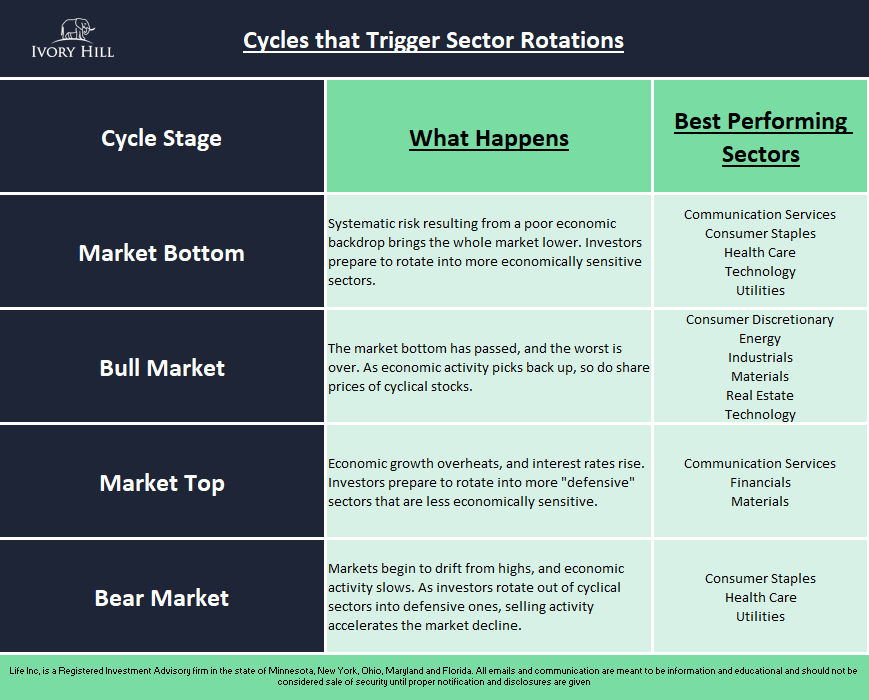

Cycles that Trigger Sector Rotations

The economy goes through cycles, and sector rotations occur at each stage. The most common cycles that investors follow are:

Changes in the Market Cycle

Changes in the Economic Cycle

Oversold vs Overbought Cycles

The market cycle typically moves ahead of the economic cycle, since investors make decisions in anticipation of the future. As such, the current market cycle stage can indicate which sectors will soon become market leaders:

This dynamic, in which the market cycle leads the economic cycle, came to fruition during both the 2008 and 2020 recessions. In 2008, the S&P 500 peaked months ahead of US Monthly Real GDP’s top. Stocks sold off in anticipation of a worsening economy.

When COVID-19 became a pandemic in early 2020, the stock market was ahead of the 8-ball once again. Such is the nature of both stock prices that discount future cash flows, and investors who always want to be one step ahead.

Layered underneath the market cycle is the economic cycle. Because economic data is released more infrequently, and investors price in their estimates beforehand, the economic cycle lags behind market movements. That said, it can provide solid confirmation of prevailing market trends. Sectors tend to perform differently based on the current economic cycle stage:

Lastly, oversold and overbought indicators can be used to hone in on investment decisions with added precision. In late 2020, the Technology Select Sector SPDR ETF (XLK) triggered a commonly used overbought signal when its relative strength index (RSI) spiked. The ETF immediately sold off by as much as 12.9% over the following months.

Sector Rotation in Practice

One argument for using a sector rotation strategy is that share prices of companies within each sector tend to move in the same direction. This is a natural effect of sector classification, whereby companies with similar business models are grouped together. At a minimum, investors can gain baseline exposure to a given sector’s sensitivities using individual stocks. Or, broader exposure can be secured using sector ETFs.

An example is the relationship of crude oil prices with major airliners American Airlines (AAL), Delta Airlines (DAL), Southwest Airlines (LUV), and United Airlines (UAL), as well as United Parcel Service (UPS) and FedEx (FDX). Despite operating in different industries, these industrials sector companies all benefit from lower oil prices, causing share prices to move higher when fuel costs decline.

Investors use a top down approach and look to macroeconomic indicators to assess the current economic cycle stage. Once favorable sectors are identified, rotations are made out of unfavorable ones and into those that are poised to grow.

Other Factors to Consider

Sector rotation involves active management, which requires frequent monitoring of market and economic events in order to capture opportunities. As explained earlier, the economic cycle takes longer to catch up to the market cycle—and markets could also fail to digest economic news efficiently. Mistiming the market cycle could cause alpha or returns to be left on the table.

Remember: rotating out of a given sector involves selling shares, and each profitable sale triggers a knock on the door from Uncle Sam to collect capital gains tax. Tax events can diminish overall returns, which is why the level of active portfolio management should be considered in order to avoid unnecessary capital gains tax.

Also keep in mind that industries aren’t as homogenous as broader sectors, and a deviation can throw off a rotation strategy. Using the previous example, low oil prices are a major tailwind for major airlines, but other industrials like railroads might suffer as crude oil shipments decline. It might be thought that a rising tide lifts all boats, but there could be outlying industries which fail to swim, reinforcing the need for thorough investment research such as a full top down approach.

Finally, past performance isn’t always indicative of future results. Even if a chart historically shows declines after a security’s peak and growth following a trough, economic and market events could alter those trajectories.

Feel free to use me as a sounding board.

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Direct: 952.828.5336

Email: kurt@ivoryhill.com

—Written 08.08.2021.

Comments