I recently had an interview with David Dierking, editor at TheStreet, who is known for his expertise in ETFs. The interview was for a featured article in Investor's Business Daily. Our discussion focused on where to deploy new capital in a market that is at all-time highs, especially during the election run-up. Click the image below.

Given the recent stock market volatility, I wanted to provide a quick update on what we are seeing in the markets.

Here’s my perspective on the recent Israeli attack on the Iranian military base.

Recent headlines concerning the Israeli strike on an Iranian military installation have raised concerns globally. However, when we take a step back, I think the impact on geopolitical tensions may be less severe than initially feared.

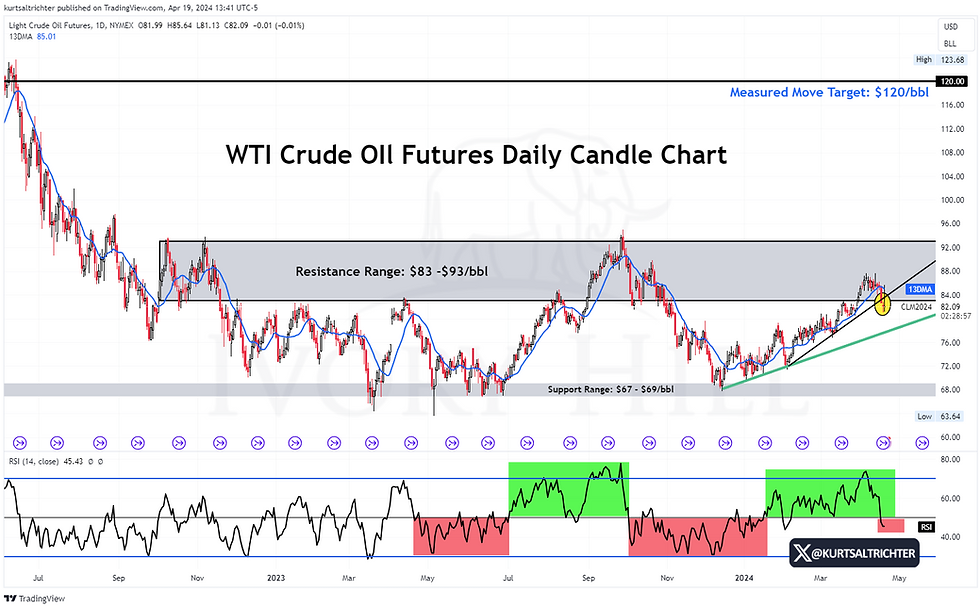

I have always stressed that oil prices are the best way to check the market’s opinion on geopolitics, and oil prices have been lower following the Israeli strike.

Similar to the attack carried out by Iran, the response from Israel was mostly ineffective and seems to have been aimed at preserving its reputation rather than escalating the situation. It's worth noting that Iran declared that it has no intentions of retaliating, which could result in a slight reduction of geopolitical risks in the future.

What Has Really Changed?

Stocks have dropped to their lowest in over two months, driven by surging yields, hawkish Fed speak, and diverse earnings, particularly in the tech sector. This trend has shifted investor sentiment from cautious to bearish. Despite these market fluctuations, the fundamental outlook for stocks remains largely unchanged from the last two weeks.

The real shift lies in investor expectations; the market no longer has overly optimistic expectations that inflation will continue to fall, imminent rate cuts, and unshakeable earnings. This adjustment brings a more realistic perspective to the forefront, aligning expectations with the current market landscape.

This is why the S&P 500 has fallen nearly 6% from its highs, but this is not due to any significant deterioration in fundamentals—they remain solid. Rather, the decline reflects a recalibration of investor expectations, as recent news and data have ceased to support overly optimistic forecasts for rate cuts and declining inflation. This shift in sentiment has grounded the market's outlook. Importantly, the foundational supports that spurred the rally from the October lows are still firmly in place. Let’s review:

Solid growth: This week's economic data has been robust, highlighted by strong retail sales, positive Philly Fed indicators, and low jobless claims. No major economic metrics currently signal any concerns about growth. Importantly, the recent market pullback is unrelated to economic growth.

Falling inflation: The data on inflation presents a mixed picture. While the decline in Core CPI has paused, rising prices for oil and other commodities pose a risk of increasing headline inflation. However, it is crucial to note that overall inflation is still tracking downward, albeit slower than anticipated.

Imminent Fed rate cuts: The information surrounding the next Federal Reserve action is mixed, yet it remains reasonable to anticipate that the next move will likely be a rate cut. The timing of this adjustment is still uncertain, with market expectations leaning towards September. Despite Fed official Williams discussing a potential hike as a hypothetical scenario, Chair Powell recently emphasized that the Fed's response to persistent inflation would involve maintaining current rate levels rather than increasing them. Therefore, while rate cuts may be postponed, they are still expected to be the Fed's forthcoming action. We likely won’t see a rate cut until unemployment hits 4-5% or the VIX spikes above 45.

AI enthusiasm: AI favorite NVDA has seen a recent drop, and ASML has tempered expectations with less encouraging remarks on semiconductor earnings. However, it's important to recognize that the overall enthusiasm for AI technology remains robust. What we're observing is merely a moderation in excitement, not a fundamental reversal. This shift suggests a more measured approach among investors, but the interest in AI as a transformative force in technology persists.

Even after a stellar 15-month run, market drawdowns can understandably cause investor anxiety. However, the shift we're seeing isn't due to underlying market fundamentals but rather to a reality check against overly optimistic expectations—a caution I have echoed for a while now. This correction, which may not yet be complete, is helping recalibrate expectations towards more realistic levels. By the way, if you are concerned about this week’s drawdown, it's worth noting that when the major crash comes it will be much more severe and occur much more quickly than what we're currently experiencing. It's important to set expectations for yourself because it’s coming at some point.

Bottom line: Our short-term and mid-term signals are firmly red, so we do expect volatility to continue. Our long-term RiskSIGNAL™ remains green, so we will remain invested in this market until our long-term signal flips red.

I view the S&P 500 reaching the 5,000 mark as an opportune time to start incrementally adding equity exposure, especially for those who have been waiting for an opportunity to enter this market; this could be your buying opportunity.

When our long-term signal is green and the VIX is below 20, we want to buy every dip. Remember our small-cap trade that we got stopped out of last week? That will be our gunpowder to fire at this market in the coming weeks.

And remember - The one fact pertaining to all conditions is that they will change.

Feel free to use me as a sounding board.

Best regards,

-Kurt

Kurt S. Altrichter, CRPS®

Fiduciary Advisor | President

Kommentare